Wednesday Reading List

The best foundation for above-average long-term performance is an absence of disasters.

Howard Marks

ICYMI: September Market Update: A Look Back & A Look Ahead – Sharing our September Market Update podcast for listeners and an edited transcript for those readers.

Summer Doldrums by Heritage Financial

Market volatility continued through the month and most major asset classes experienced negative returns. Higher interest rates due to sentiment shifting to a “higher-for-longer” mentality by the Federal Reserve was a main culprit for weak performance. Commercial real estate has garnered a lot of headlines as the “next shoe to drop” but taking a deeper dive reveals the asset class may be more resilient than it appears on the surface.

Disney’s wildest ride: Iger, Chapek and the making of an epic succession mess by CNBC

Here’s the inside story of a CEO succession plan gone awry — a cautionary tale about ego and hubris at the highest levels of corporate America. This article is based on conversations with more than two dozen people who worked closely with Iger and Chapek between 2020 and 2022.

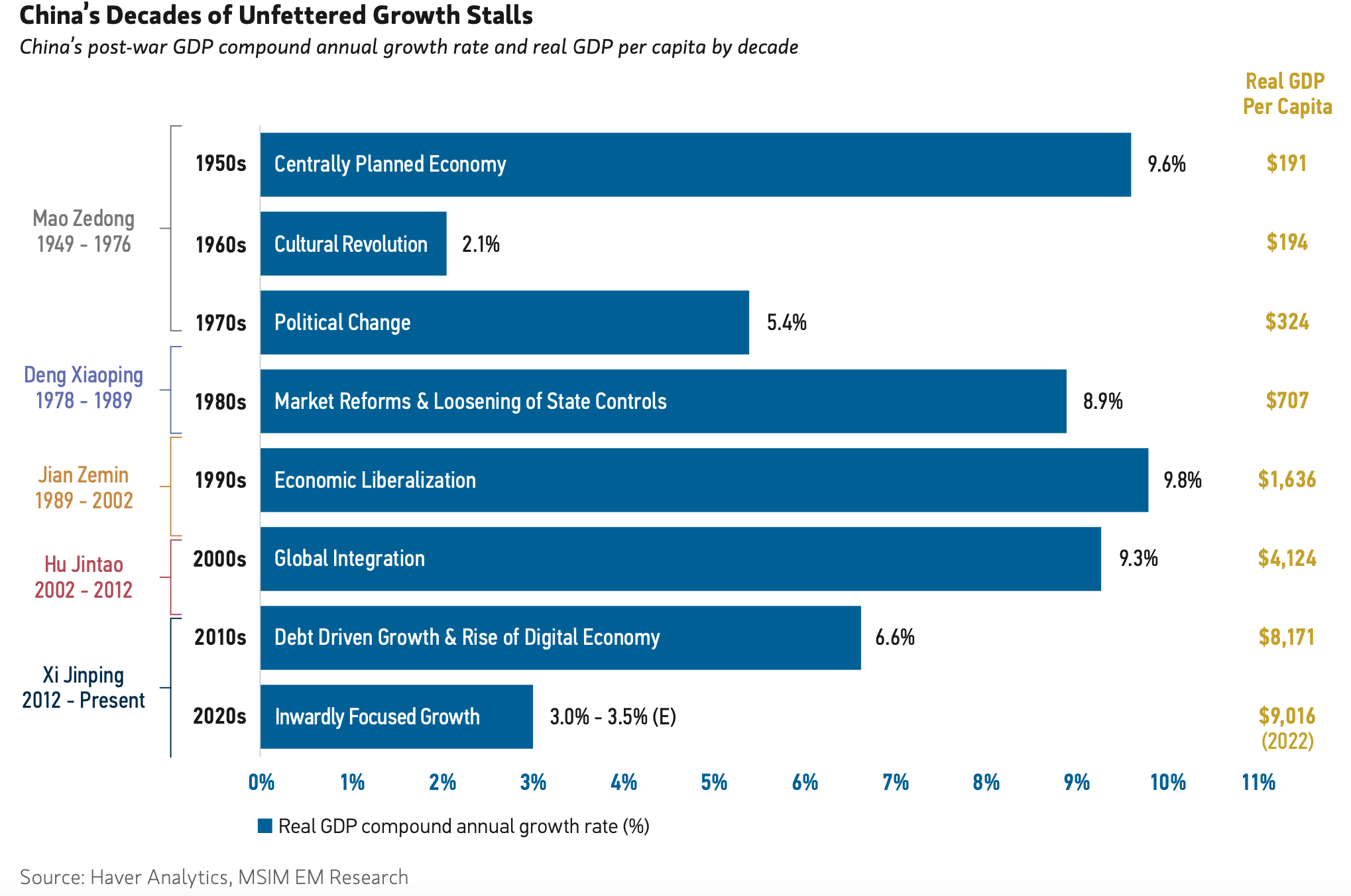

Chart of the Week

Your Schedules Just Got Crazy Again. Try These Tech Tools. by The Wall Street Journal

Skylight, Maple and Cozi are one-stop shops for digital calendars, to-do’s and shopping lists to help everyone stay organized.

Fewer Losers, or More Winners? by Howard Marks

Understanding the distinction between risk control and risk avoidance is truly essential for investors.

Podcast version here.

Treasury Yields: Where Do They Go From Here? by Charles Schwab Asset Management

We expect yields to fall later this year and into 2024 as inflation continues to cool.

Profit margins continue to defy the skeptics 🤑 by TKer

Recent market gains can be attributed to the outlook for earnings growth. And some of that expected earnings growth can be attributed to what’s arguably the most unexpected development in the corporate world over the past two years: The resilience of profit margins.

Americans’ homes are worth more than ever, but tapping into that value isn’t easy by Axios

Not only are mortgage holders locked into the golden handcuffs of a low mortgage rate that keeps them from selling their home, they’re also increasingly locked out of borrowing to tap into all their shiny new home equity.

Retirement and estate planning for unmarried couples by J.P. Morgan

Unmarried couples may find that they have some extra hoops to jump through in their financial lives. Learn about these challenges and some steps you can take to overcome them.

Podcast Recommendation

Book Recommendation

The Richest Woman in America: Hetty Green in the Gilded Age by Janet Wallach

Hetty Green was a strong woman who forged her own path, she was worth at least $100 million by the end of her life in 1916—equal to about $2.5 billion today.

Green was mocked for her simple Quaker ways and her unfashionable frugality in an era of opulence and excess; the press even nicknamed her “The Witch of Wall Street.” But those who knew her admired her wit and wisdom, and while financiers around her rose and fell as financial bubbles burst, she steadily amassed a fortune that supported businesses, churches, municipalities, and even the city of New York.

Janet Wallach’s engrossing biography reveals striking parallels between past financial crises and current recession woes, and speaks not only to history buffs but to today’s investors, who just might learn a thing or two from Hetty Green.