Rising Interest Rates

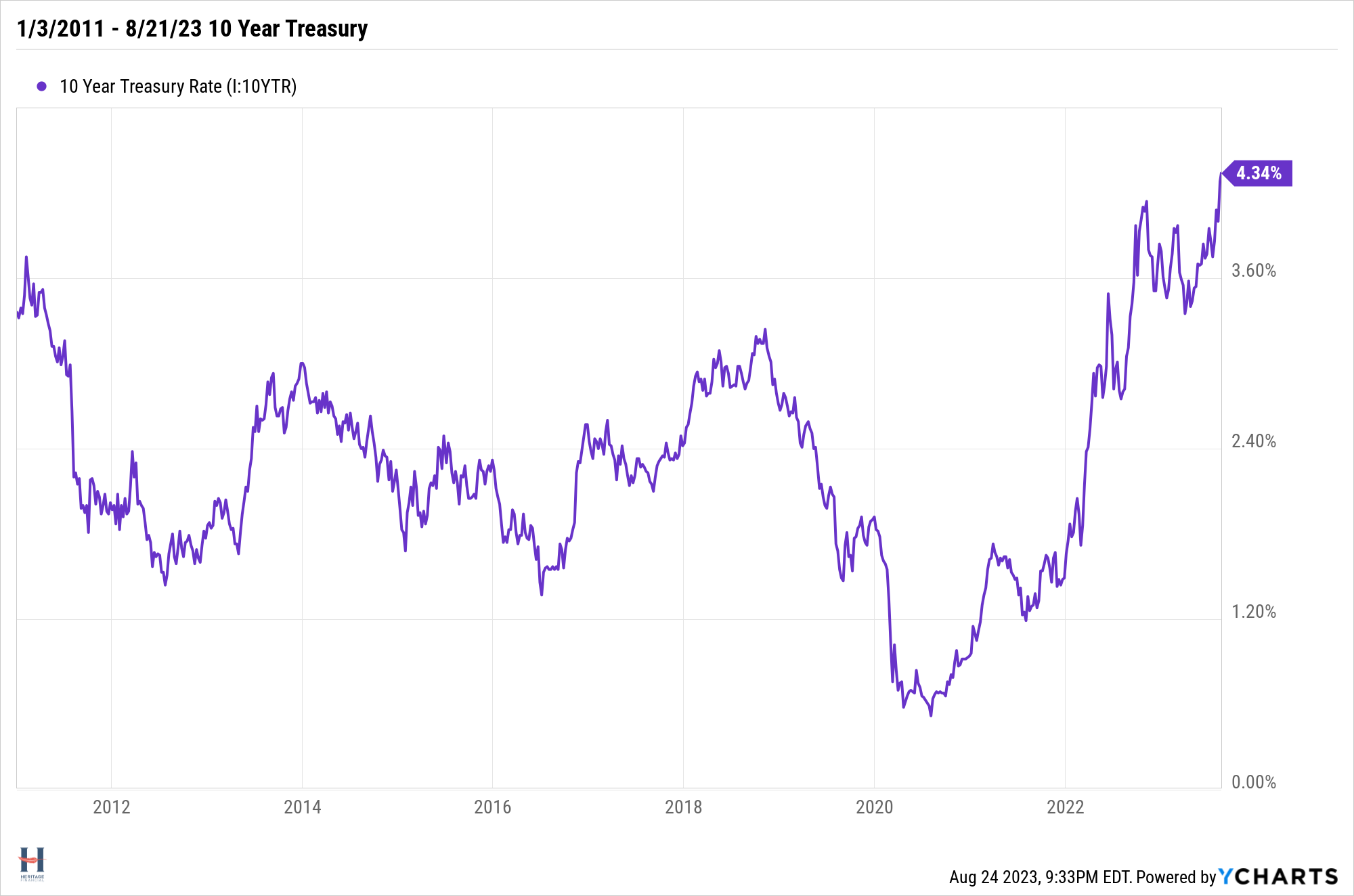

Interest rates are rising. The 10-year Treasury yield recently hit 4.34%, its highest level since 2011 and a sharp increase from June.

The Fed doesn’t set interest rates, the market does.

Bond prices and yields move in opposite directions, so rising yields mean investors are repricing existing bonds to demand a higher yield.

Two Theories Why

Supply and demand.

The current selloff is being driven in part by investors who believe the wave of federal spending and depressed demand from America’s biggest foreign creditors will likely keep long-term rates elevated for years.

Big Treasury Rout Lures Fresh Buyers – The Wall Street Journal

There’s an expectation that the Treasury will need to sell lots of long-term bonds to finance our debt and deficit spending. If there isn’t enough demand, the Treasury would have to offer higher yields, making existing bonds less attractive.

That gets us to demand.

Recent Treasury auctions have shown weaker demand, and some feel that a major Treasury debt buyer, Japan, will no longer buy as much since it has lifted the yield cap on its long-term bonds. Japanese bond yields are still lower than Treasuries, but it’s a directional headwind.

Higher for Longer

Fed rate hikes were supposed to have caused a recession by now, ultimately leading to rate cuts to stimulate the economy.

Well, the economy is growing and inflation still isn’t at the Fed’s 2% target.

It’s reasonable to believe that we’ll have higher rates for longer, and rising rates reflect this belief.

Possible Implications and Reactions

Exercise Caution in a Mixed Message Environment

Rates aren’t telling a clear story. Higher rates could be because of supply and demand concerns, or the bond market’s belief in this economy.

If it’s the latter, we still have the dreaded inverted yield curve. [An inverted yield curve is when short-term bonds yield more than long-term bonds, and it’s a reliable recession indicator]. It’s been inverted for over a year. This piece does a nice job explaining inverted yield curves and why we may still be headed for a recession.

Bottom line: prepare for ongoing volatility as the market tries to discern the economy’s direction. Avoid big bets or calls, or following investors making them. Mixed messages and uncertainty don’t mix well with boldness. Diversification and discipline do.

Expect Elevated Mortgage Rates

It’s hard to concisely explain how mortgage rates are set, but there’s enough connectivity to the economy and other rates to safely say that higher for longer will also impact mortgages and real estate (either via softening prices or less inventory).

Understand Potential Impact to Stocks

Higher yields make stocks less attractive. But you can take this too far.

I’ve seen many good investment approaches in my time. The notion that investors directly determine their stock market exposure using the 10-Year Treasury yield can be overblown.

Investors either have mostly static asset allocations and don’t believe in tactical moves, or they use what opportunities they’re seeing in the stock market to drive stock exposure. Higher rates could (and should) lead them to see fewer attractive stocks based on their rate-driven pricing models, and higher rates may signal inflation concerns that could impact equities.

I just think the adjustments happen at the margins, and it’s important to note that the 10-Year is right around its long-term average.

There’s also a view that higher rates will hurt so-called long duration stocks (growthier names), but we debunked this in a recent podcast.

Investing Concerns?

We’ve Got You Covered

Check Out