Your Money This Week

In your money this week, rate cuts are coming and here’s what it could mean for your portfolio, looking at Nvidia’s latest quarter, and recapping a good investment conversation.

Fed Rate Cuts

Fed Chair Powell spoke last week amidst market expectations for a September rate cut, and his Jackson Hole speech reinforced that expectation.

It’s clear that Powell believes that inflation is under control and the bigger risk to the Fed’s dual mandate is the labor market deteriorating even further.

“We do not seek or welcome further cooling in labor market conditions…The upside risks to inflation have diminished. And the downside risks to employment have increased…The time has come for policy to adjust.”

So, what does that mean for your money?

Stocks

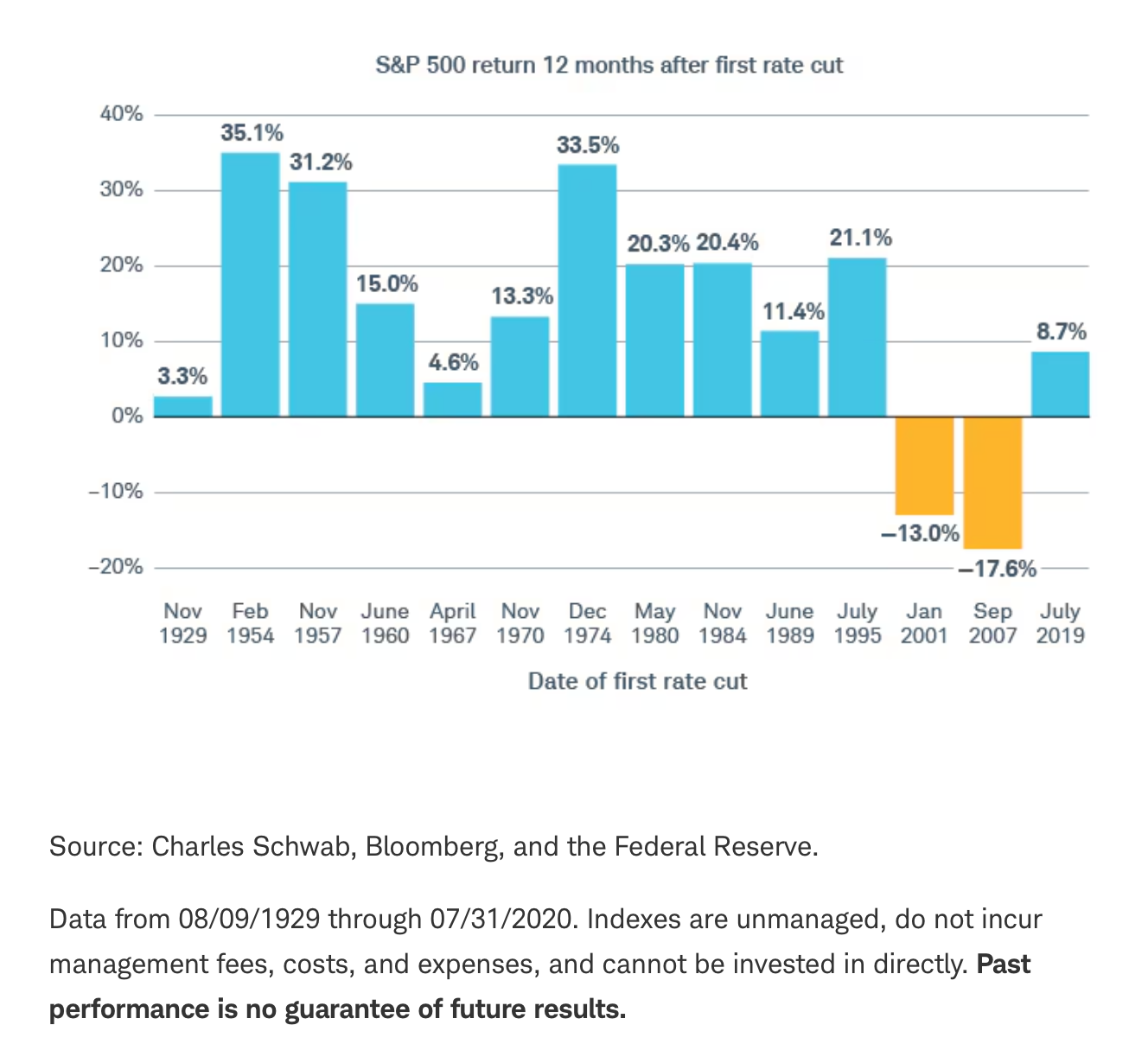

Charles Schwab recently put out a research note What Past Fed Rate Cycles Can Tell Us with this graphic showing how the S&P 500 performed twelve months after an initial rate cut.

Stocks were up 12 out of 14 times, with some relevant caveats.

First, as the piece says ,”14 interest rate cycles hardly constitute a statistically significant sample size”.

Second, the two negative time periods happened recently.

Third, and perhaps most important, is that you need to consider the environment during those rate cuts.

Simple formulas like rate cuts are good, and rate hikes are bad don’t cut it.

In 2001 and 2007, the Fed was cutting into tough times (the Tech wreck and Great Financial Crisis). Something like that could be around the corner, but these cuts have a much more mission accomplished vibe to them. The Fed is saying it hiked rates to slow inflation, it worked, and now it wants to start easing to prevent labor market pain.

So, does that mean stocks run from here?

Not so fast.

Heritage’s Chief Investment Officer, Bob Weisse, shared some interesting data on Fed rate cuts in a Wealthy Behavior podcast episode recapped here:

Looking at U.S. stock market performance over the past 14 Fed rate hiking cycles going back to 1929 you would think that when the Fed starts cutting rates stocks perform extremely well, but in that pause between the final hike and first cut (which we are likely in now), stock market performance is not so great. However, that narrative is misleading according to Bob. If you draw a line before and after 1982, it’s a different story. Stocks have done well in the last 42 years during that pause period between rate hikes and cuts, and the performance isn’t so great after the first cut. Bob posits that the Fed is getting better at its job and knowing when to cut rates, and that investors may also be pulling forward some returns into the pause period that precedes the first cut.

Silencing the Private Equity Haters and Doubting a Rate Cut Rally

If I had to bet on it (and I never do), I would have a hard time seeing the market rally hard after a September rate cut, but if the economy doesn’t deteriorate from here I don’t think we’re looking at 2001 or 2007 either.

Bonds & Cash

Rate cuts will cause money market and short-term bond yields to drop. It’s difficult to say what will happen further out on the yield curve. That’s fine, because focusing on the short-term is helpful now. Your money market yields will drop by 1% by year-end if the market is right, and they may go down further in 2025.

Investors have been happy with 5% as evidenced by the fact that money market funds hit a record level earlier this year. However, cash/cash-equivalents are poor long-term investments, and they’re about to get less attractive.

Nvidia

I don’t talk about individual stocks often, but it’s hard to ignore Nvidia. At one point it was the world’s biggest company after a stunning five year run. It’s struggled a bit since then, and this week sold-off after a strong earnings report that showed the company growing faster than expected and increasing year-over-year revenue by over 100%.

It’s hard for growth stocks priced for perfection to continue to blow away investor expectations.

Trees don’t grow to the sky.

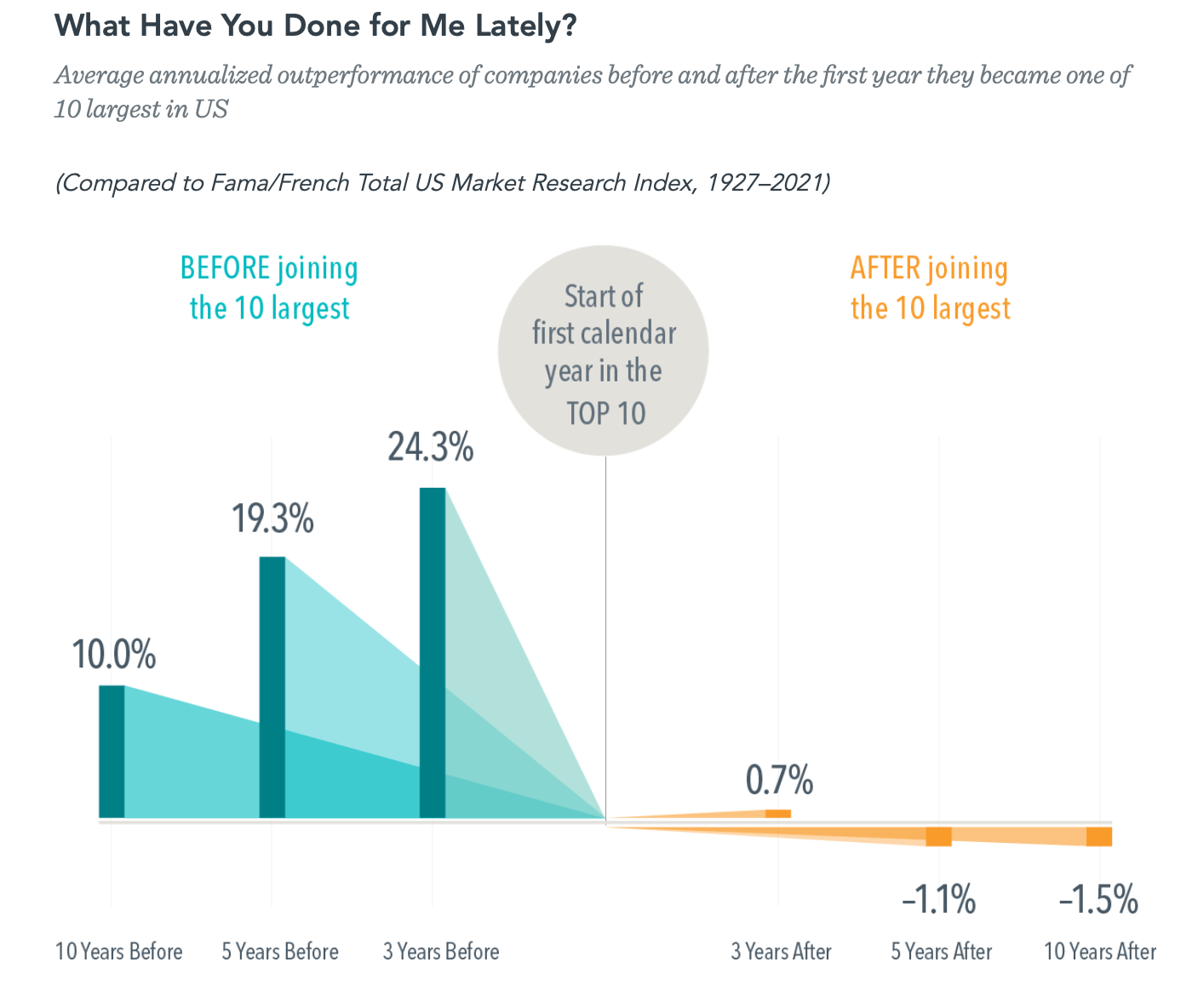

Historically, when companies have made the jump Nvidia did, future returns are weaker. It’s something to watch if you’re concentrated in that position and wondering what’s next.

Source: FAANGs Gone Value by Dimensional Fund Advisors

Talking to Sam Ro

Sam Ro, financial writer and founder of the finance newsletter, TKer joined me this week on the Wealthy Behavior podcast to help investors of all experience levels cut through today’s noisy headlines and make sense of what’s really happening in today’s markets and economy.

We discussed:

- The macro economy and the labor market slowing

- Most recent quarterly earnings being strong and whether investors should be concerned about elevated profit margins

- Takeaways from the August market meltdown

- Why Walmart is a bellwether stock to follow

- Investing during election season

- What data to monitor in the coming months and quarters to understand where the economy is going

Available here and wherever you get your podcasts

Got questions?

I’m always happy to hear from readers and help in anyway I can.